Quick Facts About Car Prices

Car shoppers can get some amazing deals on new vehicles for the current model year. After the Federal Reserve pulled the lever on the first interest rate drop since March 2020, carmakers seemed eager to rid their lots of excess stock last month, and lenders began enticing shoppers with better interest rate offers. We’ve seen more 0% financing deals than in the past several years.

In recent years, car shoppers have become accustomed to paying more than the manufacturer’s suggested retail price (MSRP). They watched car prices rise with no apparent end in sight. Even as prices started to drop, they now appear stuck in neutral. The situation left many shoppers scratching their heads, and the question our experts hear most is, “When will new car prices drop?”

New vehicle price inflation all but disappeared by the end of last year. Still, car prices have increased dramatically in the past three years. Read on for guidance if you want to purchase a vehicle. We provide the best information from our experts and dig deeper to answer concerns about car prices.

New Car Prices Fluctuating

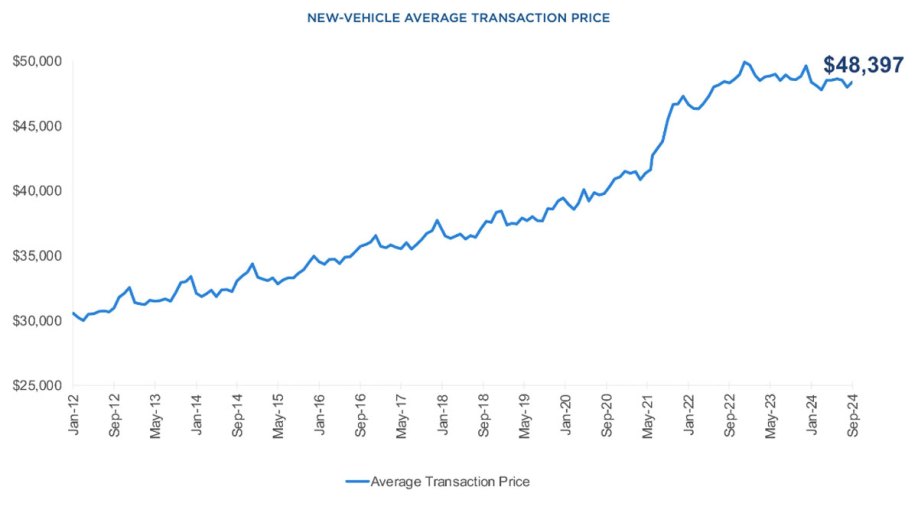

Kelley Blue Book data show that average transaction prices were $48,397 in September. Like a pingpong ball stuck between two paddles, average transactions have volleyed between the current price and $47,400 since January.

“New-vehicle transaction prices continue to be very steady this year, and higher incentive spending is helping maintain sales volume,” said Cox Automotive Executive Analyst Erin Keating. “We still believe there is potential for growth in the market for the rest of the year, but with the uncertainty of a national election around the corner and major weather events disrupting business, maybe a slow, steady pace is all we should expect.”

This volume-weighted calculation reflects all the car market realities, including high-volume vehicles like pricey pickup trucks influencing the number. For example, the report shows that full-sized pickups posted an average transaction price of about $65,000.

Additionally, electric vehicles posted average transaction prices of $56,351 in September. The nation’s largest electric vehicle (EV) seller, Tesla, saw its average transaction price decline to $58,212, compared to 59,138 in August. Still, Tesla prices are higher year-over-year by nearly 13.6%. That’s likely due to its Cybertruck (with prices starting at $82,235 with a destination fee of $1,995) because data show its average prices are much higher at $116,706.

Overall, average transaction prices remain nearly $11,000 higher than five years ago, before the COVID-19 pandemic. At that time, average transaction prices for new vehicles were $37,590.

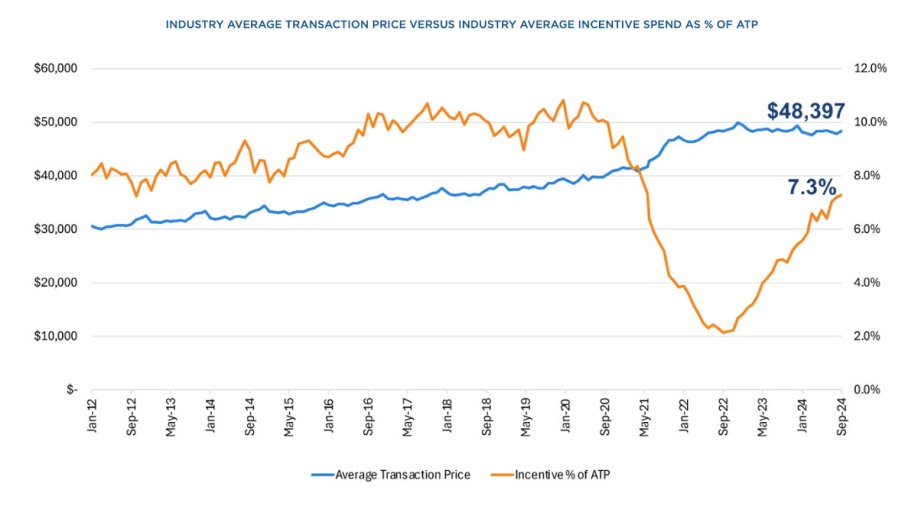

In September, manufacturers piled on more vehicle incentives, an average of $3,522, to help move 2024 models and make way for 2025 models.

What Drives New Car Prices

- Inventory availability

- Manufacturer incentives

- Dealer discounts

- Trade-in vehicle value

New Car Inventory Update

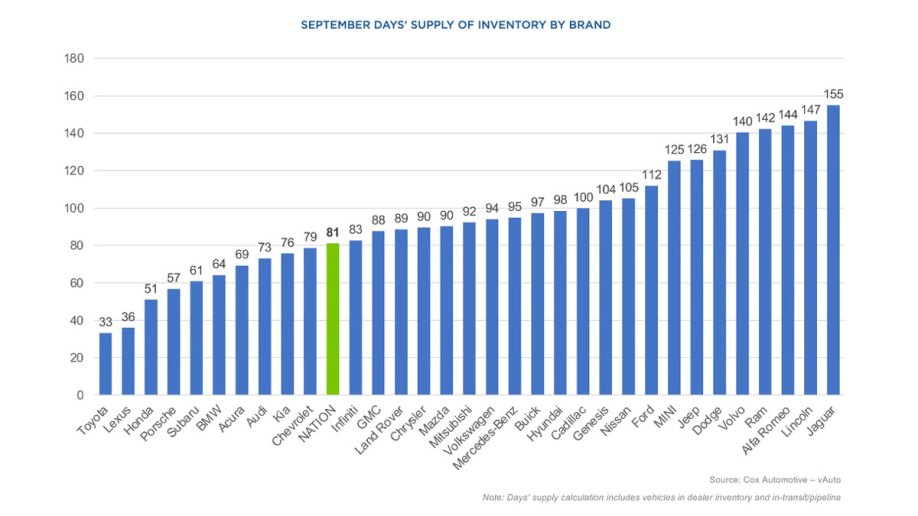

Despite back-to-back hurricanes, other volatility from port disruptions in the East and Gulf Coasts and manufacturing, and a cyber breach that shut down dealership computers, September inventory data looked almost stable. According to the Cox Automotive vAuto Live Market View, inventory looked about “normal” at 81 days. The last time we saw that was in 2019.

Dealerships measure their stock of new cars to sell in a measurement called “days of inventory,” or how long it would take them to sell out of new vehicles at today’s sales pace if the automaker stopped building new ones.

About 37% of the vehicles in a dealers’ showroom are now 2025 models. The other nearly 60% of vehicles must be sold before the end of the year. Stellantis, the parent company to the Alfa Romeo, Dodge, Chrysler, Jeep, and Ram brands, is still dealing with excess new car inventory from 2023.

Stellantis CEO Carlos Tavares recently reiterated his plan to see U.S. inventories dip below 350,000 before the end of the year while at the Paris Auto Show. According to the vAuto data, Dodge and Ram remain oversupplied, with 131 and 142 days of inventory, respectively.

Vehicle Incentives Get a Bump

Carmakers boosted their incentives to lure buyers in August. According to Kelley Blue Book’s analysts, carmakers spent 7.3% of the average transaction price, or $3,522, on incentives meant to move vehicles. That’s the highest amount in over three years and about $75 more than August. New EV incentives were 12.3% of the average transaction price, or about $6,900.

When automakers build an oversupply of cars, they discount the vehicles to get them off dealer lots. For several years, carmakers and dealerships showed no glut of cars to sell and barely offered discounts.

It’s a Buyer’s Market for New Cars

The new car landscape is a buyer’s market. Shoppers heading out to purchase a new vehicle will find bigger incentives, and qualified buyers with stellar credit will discover some decent low-interest-rate offers and lease deals, especially on electric vehicles. We’ve also seen some dealerships offering additional discounts to move 2024 models as the influx of 2025 models begins.

The number of carmakers offering 0% financing and other deals is on the rise. For example, qualified car buyers with good credit can secure 0% deals on a 2024 Nissan Pathfinder Platinum (starting at $51,010) and an additional $500 off for 36 months or a 2024 Kia EV6 (starting at $43,975) for up to 72 months.

Be sure to shop around to find the best deal on the car you want to purchase.

Shop Around for the Best Offer on Your Trade-In

Trade-in value is another factor driving car prices. A lack of used vehicle stock has kept prices higher, giving credence to the idea that buying a new vehicle is cheaper than purchasing a recent model used one. As a result, it’s a great time to trade in your car.

Dealers value your trade-in partly based on what they need in stock. Therefore, they’re more likely to offer an excellent deal to buyers on a car fewer people are looking for currently. In other words, a car shopper trading a 2018 Honda Civic for something else will be much happier with the trade-in appraisal than one with a 2021 Jeep Grand Cherokee.

Car buyers should prepare to shop their trade-in around. It’s slightly more complicated to pull off, but selling your old vehicle to one dealership and buying your new car from a different one may make sense if the final invoice numbers work out in your favor. Use the Kelley Blue Book Instant Cash Offer tool to shop your trade-in vehicle at nearby dealerships. When you let the deals come to you, selecting the best trade-in offer for your situation is easier. Remember, you can always negotiate the offer, and pitting one offer against the next is not unheard of.

The Higher Costs of Car Insurance

According to the Bureau of Labor Statistics, car insurance costs were still high in September at about 16.3% over a year earlier. Bankrate says car insurance averages about $2,300 a year for full coverage. Before you seal the deal and sign anything for a new vehicle, compare quotes for car insurance.

What to Expect: Looking Ahead

In September, the Federal Reserve dropped its best news all year. The nation’s central bank lowered its key interest rate by half a percentage point to curb an economic slowdown. More cuts could come.

Relief could bring at least a little cheer before the end of the year for auto loan interest rates. Rate cuts from the Federal Reserve take time to trickle through the economic system.

Cox Automotive Chief Economist Jonathan Smoke said that even with a rate cut today, “it is not likely that auto loan rates will decline much before year’s end.”

For shoppers, the average monthly car payment has come down. Cox Automotive data show that after peaking at $795 in December 2022, the average American car payment remained steady for the last two months at about $740. High interest rates made up some of that expense. The car loan interest rates make it hard for many consumers to afford a vehicle if they need to finance the purchase. According to the most recent Cox Automotive research, the typical new car loan interest rate was an average of 9.54% for new vehicles in September. For those buying used vehicles, rates were 13.91%.

What to Do if You Need a Car Now?

For now, you can either sit back and wait out the days for lower interest rates for your financed car. Or, if you desperately need a car now, shop around and check for manufacturer deals like cash back and 0.0% to low interest rate finance offers. If you can wait, more relief could come, especially if the Fed cuts the rate further.

Buyers looking for a used car should weigh costs carefully if they must finance right now. In some cases, newer used vehicles cost the same as new ones. Also, you can try to negotiate a great deal on a 2024 model deal because dealers want to clear their lots before the end of the year.

Editor’s Note: This article has been updated for accuracy since it was initially published. Sean Tucker contributed to this report.