Tariffs that could raise the price of most new cars could begin April 2. Or not. What you expect depends on which headline you read this morning.

Reuters: “Trump now likely to skip ‘sector-specific tariffs’ such as on autos”

Bloomberg: “Trump Says Auto Tariff Coming, Teases Reciprocal Duty Breaks”

CNBC may have it right with: “Trump pledges auto, pharma tariffs in ‘near future,’ sowing more trade confusion”

It’s not the media’s fault. The White House has sent contradictory messages on what’s likely to happen next week. That may be part of a strategy to extract concessions from trade partners. We’ll explain what car shoppers should expect.

A tariff is a tax on imports. The company importing something into the country pays it, but they usually raise prices to compensate. High tariffs leave manufacturers with a few bad options. They can stop dealing with the country that enacts them or raise prices significantly to stay in business.

President Trump has made tariffs the centerpiece of his economic strategy. He has proposed four separate sets, each likely to affect car prices. Only one is currently in force.

Four Possible Rounds of Tariffs (So Far)

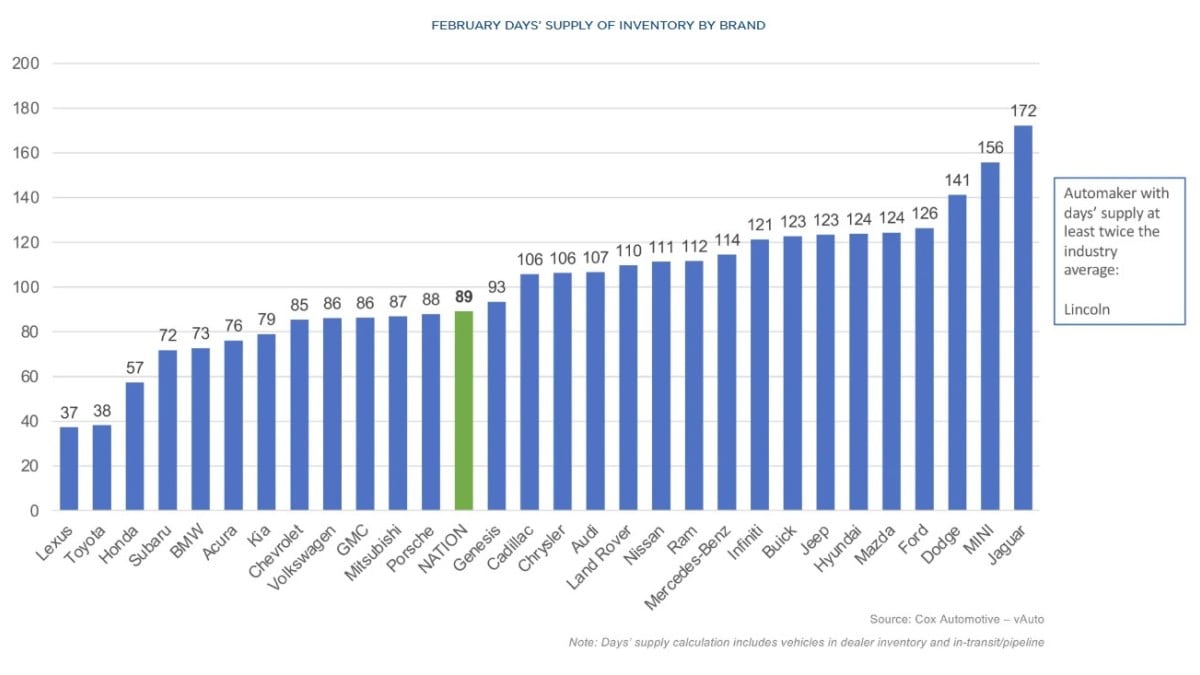

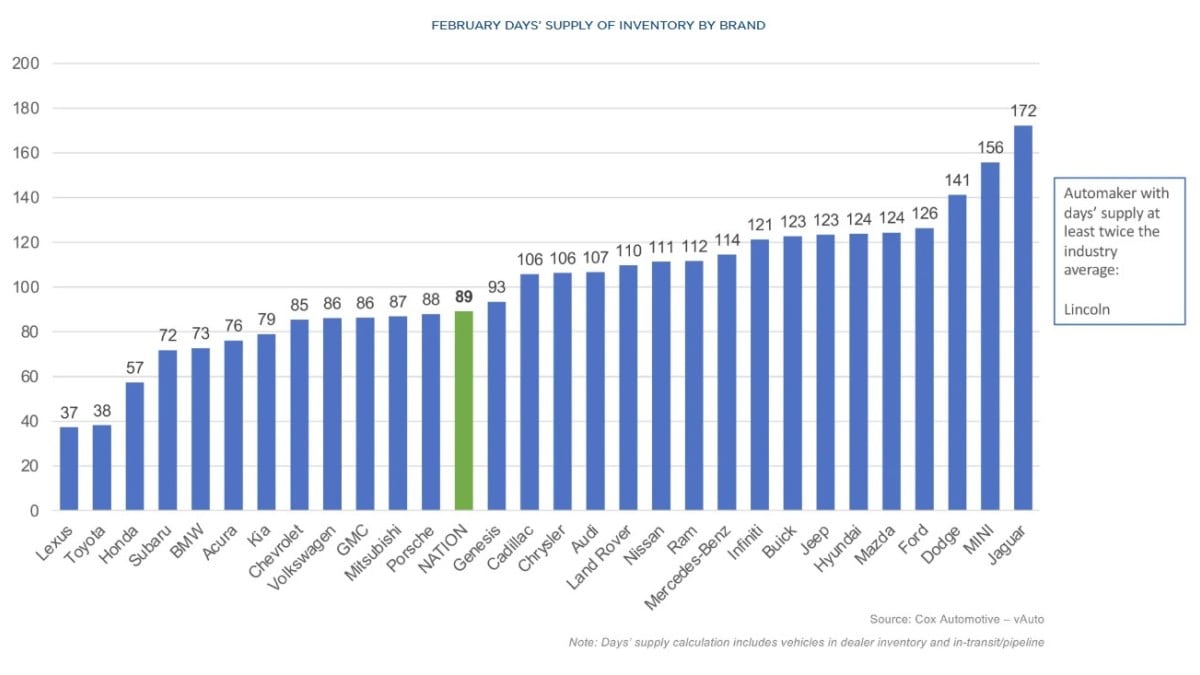

Each of the four could raise car prices, but that will take time. Automakers already have a supply of new cars in the country at pre-tariff prices. Some, like Toyota, have little more than a month’s supply. Others, like Dodge, have several months’ worth.

Tariffs on steel and aluminum began early this month. They may impact car prices the least of the four. Though most car parts are made of steel or aluminum, automakers already use as much domestic metal as they can. We’ve seen little practical effect from the steel tariffs so far.

Tariffs on everything imported from Canada and Mexico were announced for February and then delayed. The auto industry was given a separate delay through March. If the president doesn’t delay them again, they are now set to begin April 2.

Automakers build many cars in those countries for sale in the U.S., and all cars built in the U.S. use parts from the rest of North America. These tariffs may impact car prices most of the four, with some analysts suggesting that the price of a mainstream midsize SUV could rise by as much as $9,000 on average.

Trump has threatened tariffs specific to the auto industry, as high as 25% on all imported cars, but designed to “go substantially higher over the course of a year.” Those could begin on April 2.

He has also threatened “reciprocal tariffs” on American trade partners, meaning the U.S. would match any tariff a country places on U.S. goods. Those have no specific effective date, as Trump asked White House officials to study the issue and make recommendations soon.

Those last three are now in flux.

Trump’s Statements Sow Confusion

Two of the four sets could go into effect next Wednesday. However, media reports suggest that the White House is unsure what it will do on that date.

The Wall Street Journal claims, “The White House is narrowing its approach to tariffs set to take effect on April 2, likely omitting a set of industry-specific tariffs while applying reciprocal levies on a targeted set of nations that account for the bulk of foreign trade with the U.S.”

Reuters explains, “Trump said on Monday automobile tariffs are coming soon even as he indicated that not all of his threatened levies would be imposed on April 2 and some countries may get breaks, a move Wall Street took as a sign of flexibility on a matter that has roiled markets for weeks.”

Still, Trump told a cabinet meeting Monday, “We’ll be announcing cars very shortly.”

“Pressed for clarification on whether sectoral tariffs will also start that day,” CNBC reports, Trump said, “Yeah, it’s going to be everything.” Then he contradicted himself, “But not all tariffs are included that day.”

Confused yet? So are automakers and America’s trade partners. Bloomberg offers, “The president’s barrage marked the latest example of his erratic approach to trade policy, which has frazzled investors and foreign governments.”

On Monday, South Korea’s Hyundai Motor Group gave what may be the most useful hint to what’s going on behind the scenes.

CNN explains, “Hyundai and President Donald Trump announced a $20 billion investment in U.S. on-shoring on Monday, which includes a $5 billion steel plant in Louisiana.”

After announcing the investment, industry publication Automotive News notes, “Trump confirmed that Hyundai Motor Group — parent to Hyundai, Genesis, and Kia — would not be required to pay tariffs.”

It’s unclear how the White House could exempt specific companies from tariffs. However, the news suggests that companies could seek exemptions by promising future investments in the U.S. Trump’s confusing statements might lead more companies to his door to strike deals.

Carrots, Sticks, and Prices

Notably, however, Hyundai’s announcement was nothing new. The company has been increasing its facilities in the U.S. for years. The company has opened three plants in the U.S. in recent years.

During the last administration, it committed to a $12.6 billion “metaplant” in Georgia that includes an electric vehicle (EV) battery facility and a car factory. That plant “will have its official opening ceremony on March 26., but it began assembling Ioniq 5 compact crossovers in October,” Automotive News reports.

That investment started under the previous administration. It was one of many, as automakers broke ground on new factories in the U.S. to take advantage of a law the Biden administration shepherded through Congress.

That law created a $7,500 tax credit for Americans who buy EVs but required automakers to build a larger percentage of the cars domestically every year to keep qualifying. Trump has sought to dismantle it, though he hasn’t yet convinced Congress to undo a law that created jobs in many districts.

Pre-Trump, America attracted automotive jobs with carrots — build here, and we’ll help you sell cars. The carrots worked by cutting car prices for shoppers, giving Americans a $7,500 discount on many new vehicles. Under Trump, it’s using sticks — build here, or we’ll place tariffs on your products. The sticks work by raising prices for shoppers.

Historians will have to determine which approach created more jobs. Car shoppers, however, should watch the news next week to see if prices are set to rise soon.