Annual shareholder meetings for established public companies are usually pretty sedate affairs. Lawyers and executives engage in careful preparation, satisfying legal requirements, but unless the firm is under activist investor siege or is circling the drain financially, the yearly meeting comes and goes with little fanfare. Unless, of course, we’re dealing with Tesla.

Tesla’s market cap has slipped below $1 trillion, but it’s still among the world’s most valuable companies. So it was weird and suspicious that Tesla hadn’t set a date for its annual meeting, which according to Texas law was supposed to happen 13 months after the 2024 gathering: no later than July 13, as The New York Times reported. (Tesla incorporated in Texas in 2024 after having previously been incorporated in Delaware.)

Following some shareholder agitation reported by Reuters and the media noticing that Tesla was going to be late, the company told regulators yesterday that it would hold the meeting … on November 6. November 6! A four-month delay that’s going to raise all manner of questions about what the heck is going on with Elon Musk’s empire.

So what’s going on with Tesla?

There are two factors to consider here. First, Tesla will probably report its third-quarter earnings around the end of October, so the company wants some time to improve its business performance after a sales decline and stock-price slide before it faces shareholders. Improved results could quell anger and give Musk some time to meaningfully re-engage with, you know, running Tesla as CEO rather than starting a new political party, canoodling with the far-right in Germany, or teasing his knowledge of the Epstein files.

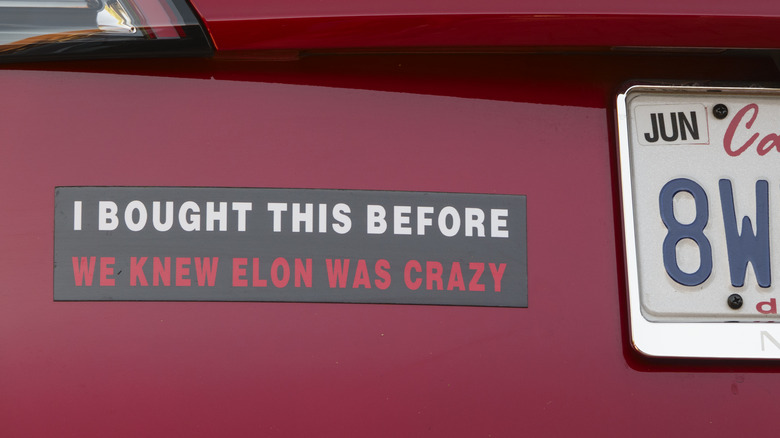

Second, Tesla wants to stall any potential shareholder agitation regarding Musk and his activities and compensation, alongside an effort to displace Tesla board members, who have been widely criticized for letting Musk do whatever he wants and allowing Tesla’s value to decline. Obviously, it’s been a whole new world for Tesla investors since last year, before Musk threw himself into electing Donald Trump and then overseeing DOGE and its helter-skelter assault on the federal bureaucracy.

It’s unlikely that Texas would have done anything if Tesla continued to blow off its annual meeting. Musk’s whole reason for re-incorporating in the Lone Star state was to escape the higher level of legal scrutiny that Tesla was facing in Delaware, where a judge had shot down his bonkers pay package. At the time, he said Texas and Nevada were states that empowered shareholders, not courts, to make decisions. But a year later Tesla now seems to think that shareholders making decisions might be a problem.

Is Tesla the first big American corporation that just doesn’t give a crap?

A situation like this would normally get the SEC’s attention, but the issue for Tesla isn’t financial: when the company reports Q2 results on July 23, Wall Street isn’t expecting great things due to reduced deliveries, but analysts also don’t think the stock is going to completely tank.

Rather, Tesla is staring down a serious governance challenge. In the past, complaints about Musk and the board usually died because shareholders were getting reliably richer. But now the big pension funds with Tesla exposure and clearcut fiduciary responsibilities have more to answer for.

As well they should. Tesla shares have slid 25 percent since a rally following the election, and one could say with a smirk that Musk barely presided over the dip, as the absentee CEO was sleeping on floors in Washington and dining at Mar-a-Lago when he wasn’t bickering with cabinet secretaries. He appears bored with the car business and has recast Tesla as an autonomous mobility, robotics, and AI company — all technologies that are currently generating negligible revenue. Musk and the Tesla board don’t want to answer to anybody right now, and this absurd delay on the annual meeting is a bet that most investors won’t ultimately care. But it’s also a risky wager that come November, currently ticked-off investors will have less to complain about.