✕

Tariffs, interest rates, and just general economic uncertainty are making for some interesting times in the HVAC industry.

With equipment prices still rising, homeowners are looking for any opportunity to save some money, and one attractive way is through payment terms.

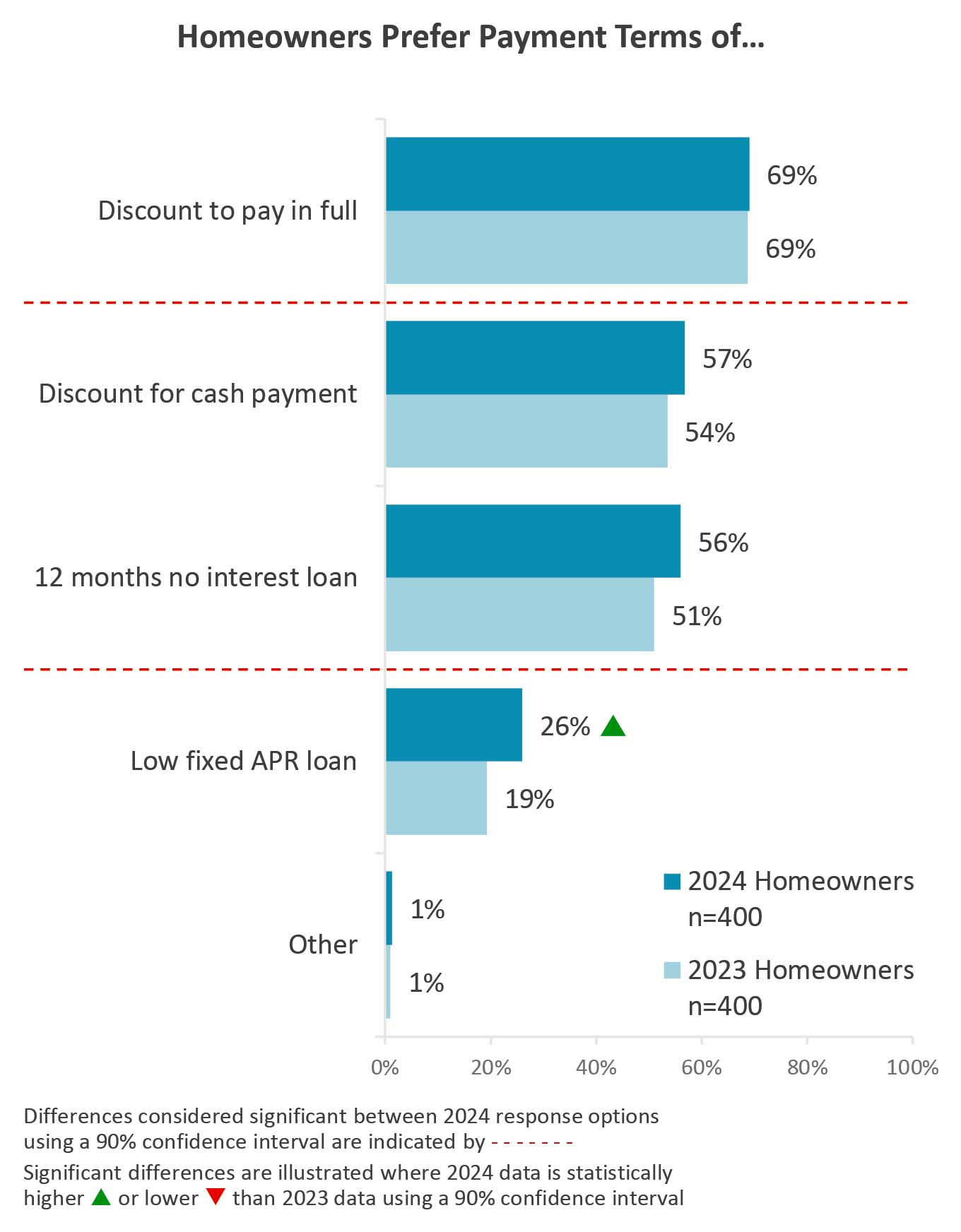

According to a new survey conducted for The ACHR NEWS by myCLEARopinion, more than two-thirds of homeowners find a discount to pay in full to be an appealing payment term, while more than half are interested in a discount for cash payment or 12 months no interest loans.

Click graphic to enlarge

PAID IN FULL: While a pay in full discount is definitely the most popular option, most homeowners prefer some type of payment terms from contractors. (Courtesy of myCLEARopinion)

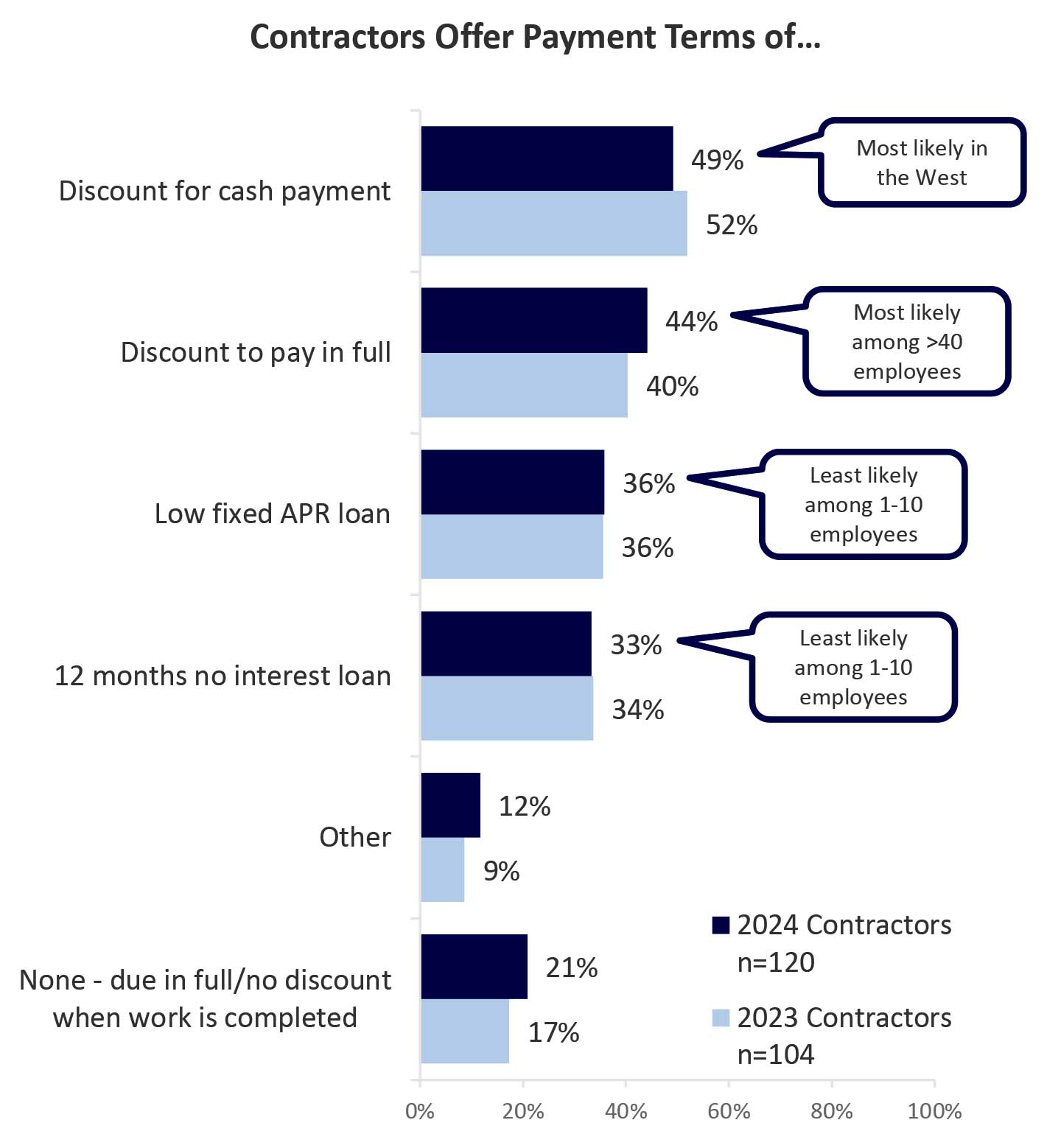

As for contractors, a third or more have indicated they provide these types of payment terms.

Broken down further, 49% offer a discount for cash payment, 44% a discount to pay in full, 36% a low fixed APR loan, 33% a 12 month no interest loan, while 21% said they offer nothing.

Click graphic to enlarge

CONTRACTOR OFFERINGS: Contractors are offering payments terms, but the demand from homeowners is still higher. (Courtesy of myCLEARopinion)

With relatively few contractors offering payment terms to meet consumer demands, this may be a good time to capture the pool of homeowners looking to get a quick discount. But, for the contractor, this doesn’t necessarily mean they’re going to be losing money.

Getting a Structure in Place

With rising equipment costs and less palatable interest rates, it’s not surprising homeowners are looking to partner with contractors who offer discounts.

But for the contractor, the question is how can they offer this service while still maintaining profitability.

Delaney Nicodemus, communications manager at Service Experts, said discounts are certainly one way contractors may work with customers to receive timely payments, particularly for smaller companies that don’t have back-office support for collections, memberships, etc.

“With an equipment leasing model like our Service Experts Advantage Program, contractors get the complete funding for installations while retaining the flexibility to implement creative discounting and promotional strategies,” Nicodemus said. “Offering homeowners incentives such as deferred payment options within these memberships can effectively attract customers while protecting profitability. Similarly, providing manufacturer and local manufacturer rebates offers an opportunity to incentivize customer purchases without compromising cash flow.”

Contractors can also reach a larger customer base by offering leasing options that benefit both parties. Contractors receive payment in full upon completion, and customers get the benefit of one low monthly payment that provides new equipment installation, maintenance, and future repairs for no money up front.

Emily Sicks, sales coach at Nexstar, said to effectively capitalize on cash payments, contractors should offer structured incentives that encourage immediate payment without undermining profitability.

“Introducing a membership program is a strategic move — not only does it build loyalty, but it also creates a recurring revenue stream that stabilizes cash flow,” Sicks said. “Memberships could include benefits like annual maintenance, priority service, and member-only discounts, fostering a long-term relationship with customers.”

When offering cash discounts, contractors must first calculate their break-even point, considering fixed and variable costs, Sicks noted. A 2-5% discount for cash payments might be appealing to homeowners while still ensuring profitability. Additionally, contractors should explore dynamic pricing strategies, such as offering greater discounts during off-peak seasons or bundling services to enhance perceived value.

“An often-overlooked strategy is positioning cash payment discounts as ‘smart financial choices’ rather than pure discounts,” Sicks said. “For example, framing it as a way to avoid financing fees or interest charges can appeal to budget-conscious homeowners while maintaining the brand’s premium positioning.”

Scott Merritt, owner of Fire & Ice Heating and Air Conditioning Inc., said if contractors are going to offer discounts, they need to build that into their pricing.

“Figure out the percentage of jobs you believe will pay in cash or in full, then use that percentage versus how much the discount you are giving so you can charge everyone for it — so you don’t have to add as much to each job,” Merritt said.

Promoting Payment Options

With more than half of homeowners favoring payment options that will benefit them, contractors offering these types of financial options have a real opportunity to set themselves apart.

One way to add these services is to partner with a financing provider, but there are a few key things to look out for.

“A primary consideration when partnering with financial institutions is the risk of customers facing penalties due to delayed or missed payments,” Nicodemus said. “For consumers that choose no interest loans and lapse the promotional period, financial institutions will impose high interest rates that are often retroactive to day one. This can cause significant financial strain and large increases to monthly payments. By offering alternatives such as a leasing program, contractors can expand their customer base while mitigating the risk of loan penalties from financial providers.”

When implementing 12-month, no-interest financing, Sicks said contractors should start by partnering with reputable financing providers that offer clear, transparent terms. The right partner will not only provide competitive rates but also support training for the sales team, helping them confidently present financing options without overcomplicating the sales process.

“Promotion of financing options should be integrated into every customer touchpoint — from digital marketing to in-home consultations,” Sicks said. “Highlight financing as a tool that enables homeowners to access high-quality solutions without immediate financial strain. Rather than positioning it as a necessity, frame it as an opportunity to achieve better comfort and efficiency at home.”

Contractors should remain vigilant about potential pitfalls, Sicks said, such as hidden fees or fine print that could erode customer trust. Setting up regular reviews of financing offers with the partner ensures the terms remain competitive, and gathering customer feedback can help identify any confusion or dissatisfaction early on.

With any financing provider, Merritt said the cost to the contractor for using that financing option needs to be at the forefront during decision making.

“You must price that into your job every time,” Merritt reiterated. “You can do the same thing with figuring out the percentage of jobs you believe will finance and then figure out the cost of it, so everyone pays for it rather than spiking a job 20% to give one customer a financing option they are looking for. Always offer financing. Never assume someone will want it or not want it. Every time you present to a customer, there should be a financed price presented.”

Increasingly Interesting Interest Rates

Interest rates have been an elusive factor, to put it kindly, and it’s still anyone’s guess as to what they will look like even just a few months down the road.

For contractors, Nicodemus said offering a fixed-rate membership plan is the most effective way to protect customers from market fluctuations.

“By not having a membership plan, homeowners are vulnerable to risks associated with inflation, tariffs, and other uncertainties when paying for maintenance,” Nicodemus said. “A key competitive advantage of membership programs, such as our Advantage Program, lies in the security they provide, protecting customers from market shifts.”

In a fluctuating market, contractors need to remain agile with their financing offers, Sicks said.

“Regularly evaluate financing programs and work with partners to introduce promotions that align with market conditions,” Sicks said. “Offering limited-time promotions, like no interest if paid in full within 12 months, can create urgency and drive sales during slow periods.”

Providing fixed-rate financing options is another strategy to offer stability and predictability to homeowners. This can be particularly attractive when interest rates are rising, as customers may want to lock in favorable terms.

“Equip your sales team with real-life scenarios and testimonials that demonstrate the long-term savings and comfort associated with investing in quality HVAC solutions,” Sicks said. “Position financing as a strategic investment in the home, not just a way to manage costs.”

From Merritt’s perspective, the uncertainty of rates means contractors shouldn’t put all their eggs in one basket.

“Contractors need to be in contact with multiple financing options to ensure that you are getting the best rates for the customer,” Merritt said. “You can’t just assume you are getting the best rates. This should be checked at least quarterly to hold financing providers honest.”

Avoiding Big Mistakes

For contractors who do offer payment terms, or for the contractor considering adding that offering, there are a few things they should know in order to avoid a costly mistake.

“The biggest mistake we see from competitors is not being thoughtful about the financing plans that are presented to the customer,” Nicodemus said. “Financial institutions will typically offer a multitude of financial plans, but many of these plans have high dealer fees associated with them, which can offer savings for the customer at the expense of contractor profitability. Offering fewer, more thoughtful financing plans and offering no fee leasing plans are both ways to protect against these risks.”

An added benefit of a leasing plan is its ability to extend the customer relationship over a longer period, Nicodemus added, and the ongoing service and maintenance provided to customers further enhances their satisfaction, creating a foundation for repeat business and referrals.

Sicks said the biggest mistake contractors make when offering financing or discounts is failing to align these offers with their overall business strategy. Offering deep discounts or too many financing choices can create confusion and devalue the brand. Instead, contractors should focus on a select few financing options that are easy to explain and understand.

“It’s also important to set clear guidelines for when and how discounts can be offered,” Sicks added. “Establishing minimum margin requirements before discounts are applied can help ensure profitability is maintained. Additionally, building the discount into value-added packages — such as offering a discount when combined with a service plan — can preserve brand value while still appealing to price-sensitive customers.”

Contractors should regularly train their sales teams on best practices for discussing financing and discounts. Practicing these scenarios can help them build confidence in presenting options clearly and closing deals effectively.

When offering financing, Merritt said contractors need to make sure they have multiple options to select to tailor to a customer that wants short or long terms.

“You must price discounts in, or you are eating your profit margin,” Merritt said. “Discounts are a wonderful thing to close deals, but if you just give discounts without factoring them into the price, then you will struggle to see the profit in your jobs.”