Paying cash is NOT a bargaining chip.

While paying cash for a new home can be an enticement to the property owner, and possibly help with price negotiations, the same does not apply when purchasing a car from a dealership.

This because you having cash at home-purchase closing time means a quick transaction, and no time-consuming mortgage-approval headaches. And mortgage hiccups can add days, maybe weeks, to the real-estate purchase process.

Should I Pay Cash for My Car?

Bargaining Chip

But, when purchasing a car or truck, the loan-application process generally takes less than an hour, and—and this is key—car dealers earn commission on your car loan, providing they arrange your financing.

And, here is where things get interesting: while car dealers earn a small commission for arranging the loan, the store also makes money by marking-up the loan. Which means, not only do you, the consumer, have to negotiate the price of the car, you also have to watch the loan interest rate.

Markup

Dealers secure funds for car loans at what is known as the “buy rate,” and then charge customers what is known as the “sell rate.” The difference is paid to the dealer by the lender as commission on the deal.

Interest Rates

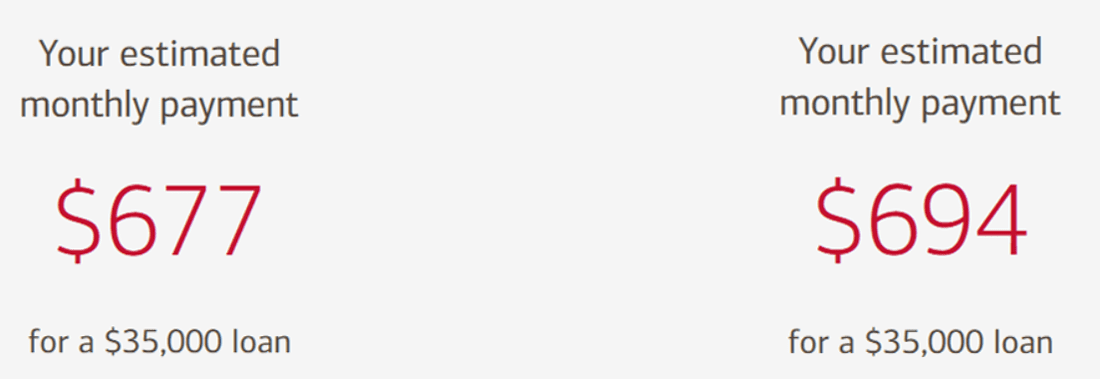

Per one source, the average car loan is marked up by more than one percent by the dealer. Today, a dealer may lock in a buy rate of 6.0 percent, and sell loans at closer to 7.0 percent. On at 60-month $35,000 loan, that’s the difference between a $674 monthly payment, and a $694 tab. Over the life of the loan, that’s exactly $1200. That’s not chump change.

Paying Cash

By paying cash—or by arranging your loan with another institution–you are actually cutting into the dealer’s profit on the sale of your vehicle.

If you do choose to finance through the dealership, be sure to know what the prevailing car-loan interests rates are. And, if the rates you’re being offered seem too high, simply delay the purchase of your vehicle until you can arrange a third-party loan that is more affordable.

If You Can, Pay Cash

To answer the original question: If you can pay cash for your car, by all means do so. Avoiding the interest on a loan is the smart thing to do—just don’t expect the dealer to be especially happy about it. Unfortunately, paying cash for a new or used car or crossover is not a bargaining chip.