- Automakers shipped 72.3% fewer cars to the U.S. this May

- Many are holding off, hoping to outlast President Trump’s tariffs

Automakers shipped about three-quarters fewer cars to the U.S. this May than last, according to a new analysis.

Industry publication Automotive News reports, “Maritime import volume for motor vehicles dropped by 72.3% in May compared with the same month a year earlier.” The numbers come from the trade database Descartes Datamyne.

The decrease comes in response to new tariffs raising the prices of cars and car parts.

Jackson Wood, director of industry strategy for global trade intelligence at Descartes Systems Group, told AN, “My read on this is that importers are pausing, hoping that more favorable tariff conditions will emerge in the medium term.”

Car Dealers Have Pre-Tariff Cars on the Lot

- In normal times, automakers try to keep several months’ worth of cars

- The numbers are falling below normal, but a long way from zero

Automakers can afford to slow down the rate of imports. Most of their dealers still have cars for sale that they imported at pre-tariff prices.

Related: How Each Automaker is Responding to Tariffs

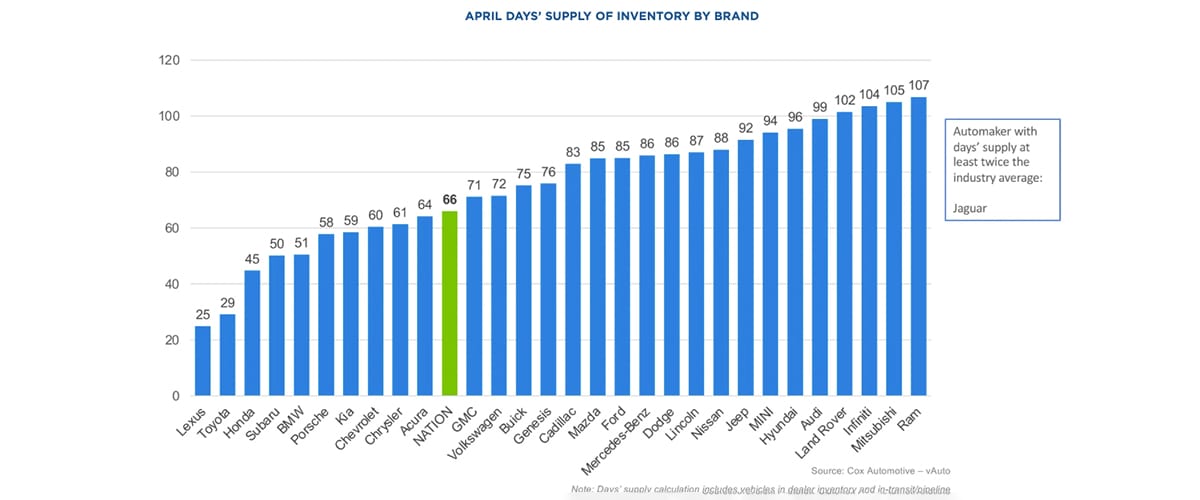

An old industry rule of thumb tells dealers to keep about 60 days’ worth of new cars on the lot, with another 15 or so in transit.

At that level, they usually have easy access to a combination of colors and features that will appeal to most buyers. Fewer costs them sales, as they might not have the right model in stock to appeal to you. More costs them money – dealers are usually making payments on each car on their lot.

Automakers ended April with 66 days in stock, a little below the 75-day target. We expect May numbers soon, and they’ll likely show a lower inventory level.

Related: Jaguar, Land Rover Restart Shipments to U.S.

But even at lower levels, that means most dealerships still have cars for sale that they imported before the tariffs kicked in. They will raise prices gradually, not all at once, as they approach the day when most of their inventory will be post-tariff.

Despite 25% tariffs, the average new car saw its price rise just 2.5% in April.

Inventory Levels Differ From Brand to Brand

Each automaker has its own inventory practices. Toyota and its Lexus luxury brand tend to run the tightest inventories in the industry, and may face higher import prices sooner than others.

Ram, Hyundai, Nissan, and Ford are among those who finished April still above the traditional 75-day target. Their dealers may not have to pay higher import fees until later in the summer.