In today’s financial landscape, a credit score plays a crucial role in shaping an individual’s financial health. It serves as a numerical representation of a person’s creditworthiness, influencing their ability to secure loans, credit cards, mortgages, and even rental agreements. A high credit score opens doors to favorable interest rates, better financial opportunities, and overall financial stability. On the other hand, a low credit score can make it difficult to access credit or result in higher borrowing costs. Given its importance, maintaining a good credit score should be a priority for anyone looking to achieve long-term financial success.

This is where gomyfinance.com comes in as a powerful tool for credit score management. Designed to help users track, understand, and improve their credit scores, gomyfinance.com provides real-time insights, personalized financial advice, and actionable steps to enhance credit health. By offering detailed credit reports and tailored recommendations, this platform empowers individuals to take control of their financial future with confidence. Whether you are looking to build, repair, or optimize your credit score, gomyfinance.com serves as an essential resource for making informed financial decisions.

What is Credit Score?

A credit score is a three-digit number that represents an individual’s creditworthiness, helping lenders assess the risk of extending credit. Typically ranging from 300 to 850, a higher score indicates responsible credit management and increases the likelihood of loan approvals with favorable terms. Credit scores are used by banks, credit card issuers, mortgage lenders, and even landlords to determine financial trustworthiness. A good credit score can lead to lower interest rates, higher credit limits, and better financial opportunities, while a poor score may result in loan denials or costly borrowing terms.

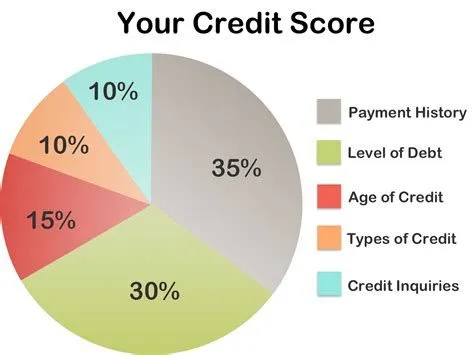

Understanding how credit scores are calculated is essential for maintaining and improving financial health. Several key factors influence credit scores, and managing them effectively can lead to a stronger financial profile.

Key Factors Influencing Credit Scores

1. Payment History (35%)

The most significant factor in credit score calculation is payment history—whether bills are paid on time. Late or missed payments can negatively impact a score, while a consistent history of on-time payments boosts it. Even one late payment can cause a noticeable drop, so setting up reminders or automatic payments is a smart way to stay on track.

2. Credit Utilization (30%)

Credit utilization refers to the percentage of available credit that is being used. A low credit utilization ratio (below 30%) is ideal, as it shows lenders that the borrower isn’t overly reliant on credit. High utilization—maxing out credit cards or carrying large balances—can signal financial distress and lower the score. Keeping balances low and making frequent payments helps maintain a healthy credit utilization ratio.

3. Length of Credit History (15%)

The longer a person has been using credit, the better their score. This factor considers the age of the oldest credit account, the age of the newest account, and the average age of all accounts. A longer credit history provides more data on financial behavior, so it’s advisable to keep older accounts open, even if they are not actively used.

4. Credit Mix (10%)

A diverse mix of credit accounts—such as credit cards, installment loans, mortgages, and retail accounts—can positively impact a score. Having a combination of different types of credit shows the ability to manage multiple financial responsibilities. However, opening new credit accounts solely to improve credit mix is not recommended, as unnecessary debt can be risky.

5. New Credit Inquiries (10%)

Whenever a person applies for new credit, lenders perform a hard inquiry on their credit report. Too many inquiries in a short period can lower the score, as it may indicate financial instability or a higher risk of default. It’s best to apply for credit only when necessary and to avoid excessive applications within a short time frame.

By understanding these key factors and how they influence credit scores, individuals can take proactive steps to improve their financial standing. Tools like gomyfinance.com credit score monitoring can provide valuable insights and help users make informed decisions to maintain a strong credit profile.

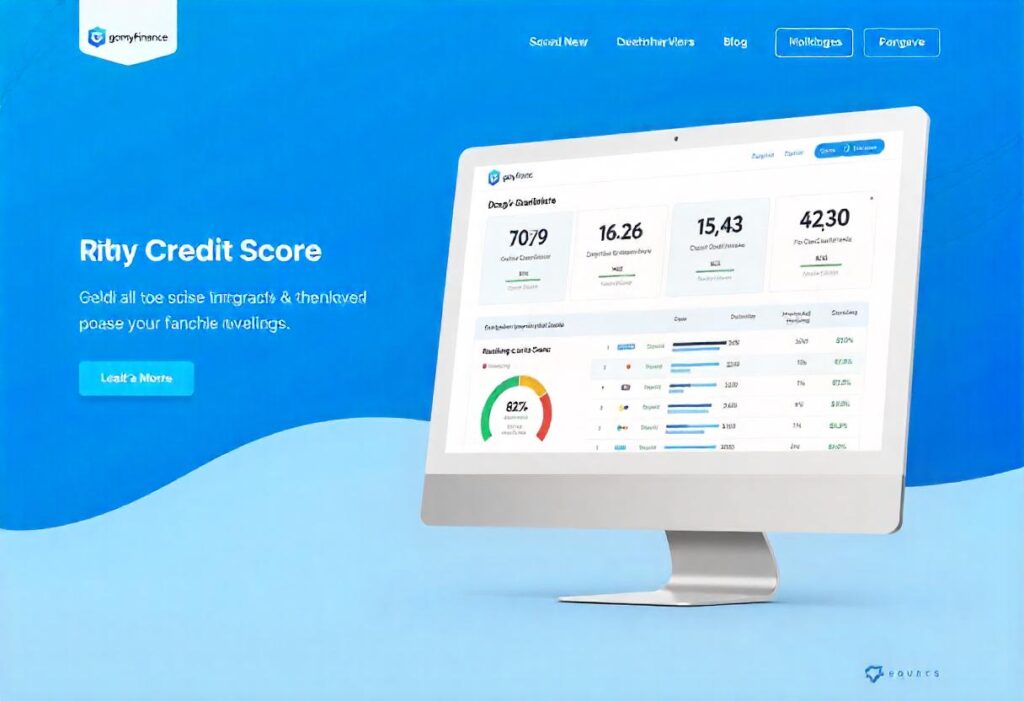

How gomyfinance.com Enhances Credit Score Management

Maintaining a good credit score requires consistent monitoring, informed decision-making, and strategic financial planning. gomyfinance.com simplifies this process by offering a comprehensive platform designed to help users track, manage, and improve their credit scores effectively. With its user-friendly interface and data-driven insights, gomyfinance.com empowers individuals to take control of their financial health. Here’s how:

1. Real-Time Credit Score Tracking and Updates

One of the most crucial aspects of credit score management is staying updated on changes in your credit profile. gomyfinance.com credit score tracking provides real-time updates, allowing users to monitor fluctuations and understand the factors influencing their scores. With instant alerts on significant changes—such as late payments, new credit inquiries, or account updates—users can take immediate action to protect and enhance their credit standing.

2. Personalized Action Plans for Credit Improvement

Every individual’s credit journey is unique, and gomyfinance.com recognizes this by offering customized action plans tailored to each user’s financial situation. Based on a user’s credit history and current score, the platform suggests specific, actionable steps to improve credit health, such as:

- Reducing credit utilization

- Setting up payment reminders

- Disputing inaccuracies in credit reports

- Strategically applying for new credit

By following these personalized recommendations, users can work towards boosting their credit scores efficiently and sustainably.

3. Detailed Insights into Credit Reports

Understanding a credit score requires more than just knowing the number—it involves analyzing the full credit report to identify strengths and areas for improvement. gomyfinance.com provides users with a detailed breakdown of their credit reports, highlighting:

- Open and closed accounts

- Payment history trends

- Credit utilization percentages

- Factors positively or negatively affecting the score

By offering these insights in a clear and organized manner, users can identify potential issues, correct errors, and make informed financial decisions.

4. Educational Resources for Better Financial Understanding

Financial literacy is key to long-term credit health, and gomyfinance.com goes beyond tracking scores by providing educational tools and resources. Users can access:

- Informative articles and guides on credit management

- Expert tips for improving financial habits

- Step-by-step explanations of how credit scores work

- Strategies for achieving long-term financial stability

By equipping users with the knowledge and skills needed to make smart financial choices, gomyfinance.com ensures they have the confidence to navigate their credit journey successfully.

The Importance of Regular Credit Report Monitoring

A credit report serves as a detailed record of an individual’s financial history, influencing their ability to secure loans, credit cards, and even rental agreements. Regular monitoring of one’s gomyfinance.com credit score and credit report is essential for maintaining financial health, preventing fraud, and ensuring accuracy. Here’s why keeping a close eye on your credit report is crucial:

1. Identifying and Correcting Errors in Credit Reports

Mistakes in credit reports are more common than many people realize, and even a small error can negatively impact a credit score. Inaccurate information—such as incorrect account balances, duplicate accounts, or misreported late payments—can lead to unnecessary credit denials or higher interest rates.

Regular credit report checks allow users to:

- Spot incorrect personal details (such as misspelled names or wrong addresses).

- Identify incorrect payment statuses (payments marked as late when they were on time).

- Detect duplicate or outdated accounts that may be lowering their score.

- Dispute errors with credit bureaus to ensure an accurate financial record.

With gomyfinance.com, users can easily access their credit reports and receive guidance on how to dispute inaccuracies effectively.

2. Detecting Signs of Identity Theft or Fraud

Identity theft is a growing concern, and fraudsters can open accounts, take out loans, or make unauthorized transactions in someone else’s name. If left unnoticed, fraudulent activities can damage credit scores and lead to financial losses.

Regular credit report monitoring helps users:

- Detect unauthorized accounts or transactions they didn’t initiate.

- Identify suspicious changes in personal details (such as an unknown address linked to their profile).

- Recognize unexpected hard inquiries that suggest someone may be applying for credit fraudulently.

- Take quick action to report fraud, freeze accounts, and prevent further damage.

gomyfinance.com provides real-time alerts for suspicious activity, helping users act swiftly to protect their credit and personal information.

3. Staying Informed About Changes in Credit Profiles

Credit scores fluctuate based on various factors, such as payment history, credit utilization, and new credit applications. Regular monitoring ensures that individuals stay informed about changes in their credit profile and can adjust their financial habits accordingly.

By frequently checking their gomyfinance.com credit score, users can:

- Understand why their score is increasing or decreasing.

- Track the impact of recent financial decisions (e.g., paying off debt or opening new credit accounts).

- Maintain healthy credit utilization levels.

- Plan strategically before applying for a loan or mortgage.

Having access to real-time updates allows users to make informed financial decisions and stay ahead of potential credit issues.

4. Demonstrating Financial Responsibility to Potential Lenders

Lenders, landlords, and even employers often assess credit reports to evaluate financial responsibility. A well-maintained credit report reflects responsible money management and can lead to better financial opportunities.

Regular credit monitoring helps users:

- Maintain a positive credit history, making them more attractive to lenders.

- Show consistent financial responsibility through timely payments and low credit utilization.

- Improve their chances of securing loans and credit at lower interest rates.

- Build a strong credit profile for future financial goals like buying a home or starting a business.

By using gomyfinance.com to track and improve their credit scores, individuals can enhance their financial credibility and unlock better financial opportunities.

Effective Strategies for Boosting Your Credit Score

A strong credit score opens the door to better financial opportunities, including lower interest rates, higher credit limits, and improved loan approval chances. By adopting smart financial habits and leveraging tools like gomyfinance.com credit score monitoring, individuals can work towards building and maintaining a high credit score. Here are some of the most effective strategies:

1. Consistently Paying Bills on Time

Payment history is the most influential factor in a credit score, accounting for 35% of the calculation. Missing even a single payment can lead to a significant drop in credit score. To ensure timely payments:

- Set up automatic payments for credit cards and loans.

- Use reminders or alerts to avoid missing due dates.

- Pay at least the minimum amount required, but aim to pay in full whenever possible.

2. Maintaining Low Credit Utilization Ratios

Credit utilization—the percentage of available credit being used—makes up 30% of a credit score. High utilization signals financial strain and can negatively impact the score. To maintain a healthy ratio:

- Keep credit utilization below 30% of your credit limit.

- Pay down balances frequently rather than waiting for the due date.

- Request a credit limit increase to reduce utilization without increasing spending.

3. Becoming an Authorized User on Accounts with Positive Payment Histories

If a trusted friend or family member has a well-managed credit card with a strong payment history, becoming an authorized user can help boost your credit score. Benefits include:

- Gaining positive payment history without applying for new credit.

- Improving credit age and utilization ratio.

- Benefiting from increased credit access without personal liability for the debt.

Before becoming an authorized user, ensure the primary account holder maintains responsible credit habits to avoid negative impacts.

4. Regularly Reviewing Credit Reports for Inaccuracies

Errors on a credit report can lower your score unfairly, so it’s essential to review reports frequently. By using gomyfinance.com credit score monitoring, users can:

- Identify incorrect account information or late payment errors.

- Spot fraudulent activity or unauthorized credit inquiries.

- Dispute errors with credit bureaus to ensure an accurate and fair credit score.

5. Limiting the Number of New Credit Applications

Every time you apply for new credit, lenders perform a hard inquiry, which can temporarily lower your score. To avoid unnecessary hits to your credit:

- Apply only when necessary—too many applications in a short period can signal risk to lenders.

- If comparing loan offers, do so within a short timeframe (usually 14-45 days) to minimize impact.

- Focus on improving existing credit accounts instead of frequently opening new ones.

Debunking Common Credit Score Myths

Misconceptions about credit scores can lead to poor financial decisions. Let’s clarify some of the most common myths:

1. Clarifying Misconceptions About Credit Score Checks

- Myth: Checking your own credit score lowers it.

- Fact: Personal credit checks (soft inquiries) do NOT affect your score. Only hard inquiries from lenders impact it.

2. Understanding the Impact of Carrying Credit Card Balances

- Myth: Carrying a balance improves your credit score.

- Fact: Paying your balance in full each month is better for your credit score and helps you avoid interest charges.

3. Effects of Closing Accounts on Credit Scores

- Myth: Closing old credit accounts improves your credit score.

- Fact: Closing an account can reduce credit history length and increase your credit utilization ratio, potentially lowering your score.

4. Comprehensive Factors Determining Credit Scores Beyond Just Debt Levels

- Myth: Income level affects credit scores.

- Fact: Credit scores are based on credit behavior, not income. A high salary doesn’t guarantee a high score.

Understanding these myths helps individuals make better financial choices and manage their gomyfinance.com credit score effectively.

Conclusion

A credit score is more than just a number—it determines access to loans, credit cards, rental agreements, and even job opportunities. A strong credit score leads to lower interest rates, better financial stability, and increased borrowing power.

With tools like gomyfinance.com credit score monitoring, users can:

- Track their credit score in real-time.

- Receive personalized credit improvement plans.

- Detect and correct errors or fraudulent activities.

- Learn from educational resources to make smarter financial decisions.

Improving and maintaining a credit score requires consistent effort and smart financial habits. By implementing the strategies outlined in this guide and leveraging gomyfinance.com for expert guidance, individuals can take full control of their credit journey and unlock better financial opportunities.

Start monitoring and improving your credit today with gomyfinance.com credit score tools!