According to industry insiders cited by Maeil Business, Kia is evaluating the implementation of the EREV system in the Telluride, a semi-large SUV that has gained immense popularity in the U.S. The move is seen as part of Kia’s broader strategy to meet the growing demand for electric mobility while addressing the range anxiety often associated with pure electric vehicles (EVs).

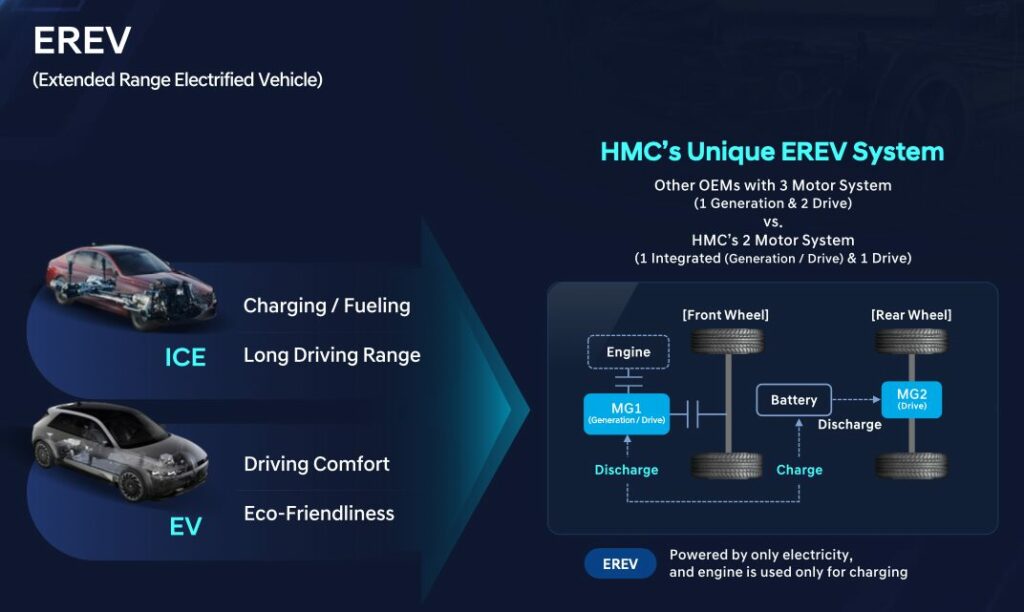

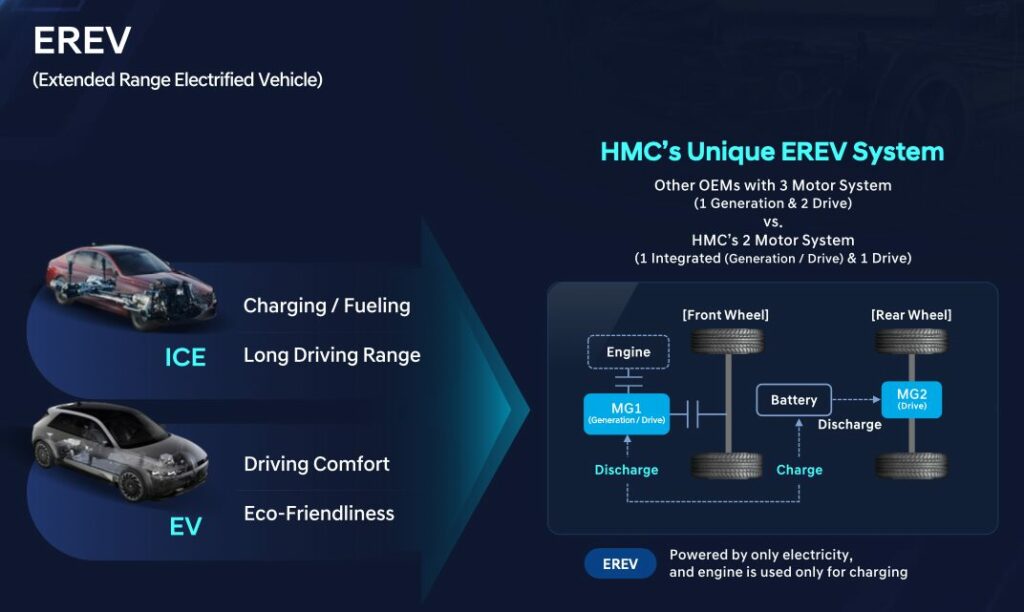

Unlike conventional hybrid vehicles, which primarily rely on gasoline engines and use batteries as a secondary power source, the EREV system flips the equation. It utilizes a large-capacity battery as the main propulsion source, while the engine functions solely as a generator to recharge the battery—thereby extending driving range significantly without sacrificing environmental benefits.

EREV vs. Pure EV: Overcoming the Range Barrier

While current pure EVs typically offer around 500 kilometers of range per charge, EREV technology can double that, reaching or even exceeding the 1,000-kilometer threshold. This makes EREVs particularly attractive for markets like North America, where long-distance travel is common and charging infrastructure is still developing.

Hyundai Motor Group—Kia’s parent company—is already applying EREV technology to mid-size SUVs like the Hyundai Santa Fe and Genesis GV70. The Telluride, being a larger and heavier vehicle, represents a new frontier in hybrid electrification. The group is also installing its advanced TMED2 hybrid system in Hyundai’s Palisade, signaling a broader shift toward electrified semi-large SUVs.

North America and China: Key Markets for EREV Rollout

Hyundai Motor Group Vice Chairman Jang Jae-hoon previously confirmed during the CEO Investor Day that EREV mass production is set to begin in North America and China by late 2026. These regions have been strategically chosen due to their strong demand for large SUVs and increasing regulatory pressure for cleaner transportation solutions.

The Telluride, which sold 29,843 units in Q1 2025—beating out the Chevrolet Tahoe—has shown strong market potential in the U.S. Its transformation into an EREV system model could position it as a leading eco-friendly SUV in a segment currently dominated by gasoline-powered competitors like the Toyota Grand Highlander, GMC Yukon, and Chevrolet Suburban.

Production Prospects and Model Expansion

There’s speculation that Hyundai Motor Group may utilize its dedicated EV plant, HMGMA (Hyundai Motor Group Metaplant America), for the production of EREV-equipped vehicles like the Telluride, Santa Fe, and GV70. Although initially built for pure EVs, HMGMA is expected to also handle EREV and next-generation HEV models as demand grows.

Looking ahead, the group plans to expand EREV technology to future models such as Hyundai’s “TE” and Kia’s “TV” projects, with launch timelines set beyond 2028.

Global Competition: EREV Development Accelerates Worldwide

Kia is not alone in this pursuit. Major global automakers are rapidly investing in EREV systems as a more efficient and practical alternative to traditional hybrids and fully electric models.

- Stellantis is developing a 1,100-kilometer range EREV version of the Ram 1500 pickup.

- Ford is prioritizing EREV over pure EVs in its large SUV and truck lineups.

- Mazda has already launched an EREV variant of its compact MX-30 SUV in Europe.

Even Volkswagen, historically more invested in plug-in hybrid electric vehicles (PHEVs), is shifting gears. CEO Oliver Blume recently announced plans to enter the EREV market by 2026, signaling a broader industry transformation.

Chinese Automakers Lead in EREV Adoption

Chinese companies are currently leading the global EREV market. Li Auto’s L7 SUV sold over 134,000 units last year, setting a strong precedent. Other brands like Leapmotor, Changan, Chery, Dongfeng, and Xpeng have launched EREVs offering ranges of up to 1,200 kilometers.