China has already overtaken Korea to become Australia’s third largest supplier of new vehicles, and a new report says it’ll take the top spot by 2035.

The Australian Automotive Dealer Association (AADA) commissioned the Centre for International Economics (CIE) to analyse Australia’s past, current and future automotive trading partners.

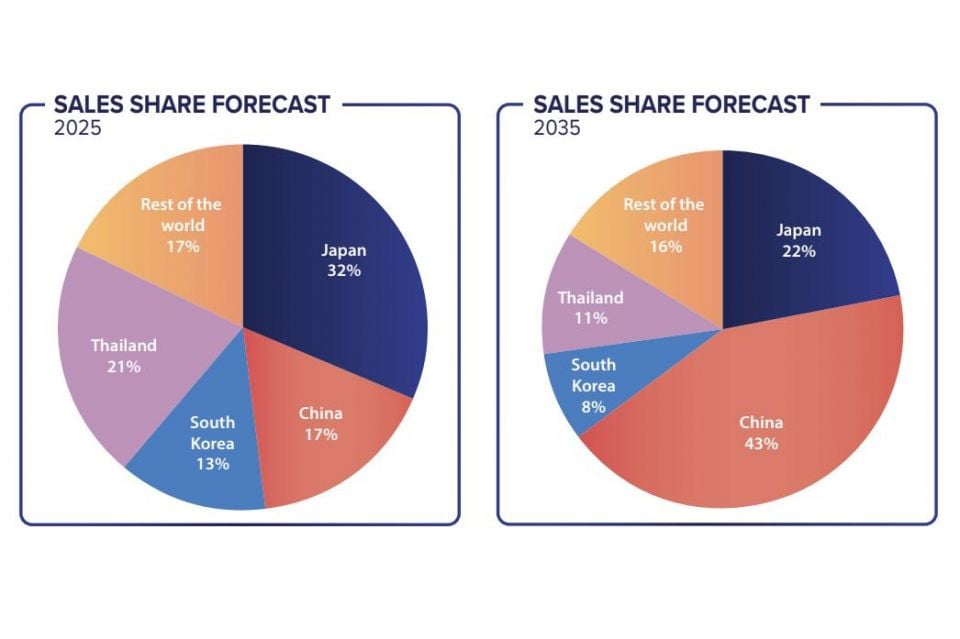

The CIE has projected Chinese-built vehicles will account for 43 per cent of Australia’s new-car market in 2035, up from 17 per cent this year.

This will come at the expense of Japanese-built cars, whose share is projected to drop from 32 to 22 per cent, as well as Thai-built vehicles (11 per cent, down from 21 per cent) and Korean-built vehicles (8 per cent, down from 13 per cent).

The CIE forecasts other countries of origin will account for the remaining 16 per cent of the market, down from 17 per cent in 2025.

CarExpert can save you thousands on a new car. Click here to get a great deal.

China already dominates the local electric vehicle (EV) market, accounting for 65 per cent of imports. But it’s not just EVs powering its growth here, with exports of combustion-powered vehicles also rising.

Enabling China’s rise, the report says, is the Chinese government’s investment and support in developing EV and plug-in hybrid (PHEV) technology and manufacturing capabilities; an ongoing drop in production costs; as well as an aversion to price increases like those imposed by brands from other countries.

But the AADA warns the Australian Government is inadvertently boosting sales of Chinese cars in our market through its New Vehicle Efficiency Standard (NVES).

“While overall sales from many countries are still projected to grow, China stands out and is set to benefit the most from the introduction of the NVES,” the AADA says in its report.

“Its strong position in EV manufacturing, supported by supply chain advantages and government backing, means vehicles produced in China are expected to gain market share at a faster rate, in contrast to the slower grow other exporting countries may observe.

“This low emissions transition highlights a broader structural shift. As emission standards tighten, supply chains globalise and EV technology dominates, China is set to play an increasingly central role in Australia’s automotive future and redefine our automotive landscape.”

The AADA says in its report that the findings are based on an assumption NVES fleet emissions reductions will continue past the legislated 2029 target.

Coming into effect on January 1, 2025, with penalties being accrued from July 1, the NVES sets fleet-wide emissions targets for new-vehicle brands in Australia.

If automakers exceed an average carbon emissions target for the vehicles they sell each year, they will be penalised $100 per g/km of CO2 for every vehicle which exceeds the target.

For 2025, the mandate for passenger cars (Type 1) is 141g/km of CO2, with light commercial vehicles and heavy-duty SUVs (Type 2) set at 210g/km or less. These limits will get tighter every year, landing at 58 and 110g/km respectively in 2029.

Chinese auto brands have been among the quickest and most aggressive in rolling out EVs and PHEVs in our market to cater to buyer demand and also meet these emissions standards.

BYD only offers these powertrain types globally, while Chery, GWM and MG all offer a mix of hybrid, PHEV and EV models, and fledgling brands like Deepal and Xpeng are EV-only here.

It isn’t just Chinese-owned brands, including Volvo and Polestar, that are selling Chinese-built vehicles here.

BMW, Cupra, Kia and Tesla all produce vehicles in China and export them to markets such as Australia, and they could be joined in the coming years by others such as Mazda and Nissan.

It has been a meteoric rise for China, and follows the rise of Thailand, Korea and Japan in our market.

There are parallels here beyond dramatic sales growth. Many of the first Korean and Japanese cars sold here were widely regarded as being flawed or ill-suited to our market, but manufacturers like Hyundai and Toyota were able to over time adapt to our market conditions and offer more suitable vehicles.

Chinese brands have invested in local vehicle development testing in our market, but GWM is perhaps a standout example of tailoring vehicles to Australian conditions, having appointed Holden’s former lead vehicle dynamics engineer as its local ride and handling expert.

Many Chinese brands have set ambitious goals for our market.

MG wants to be a top-three player in Australia by 2030, while GWM is also aiming to be in the top five by that year.