The long shadow of the pandemic continues to loom over the automotive industry, as vehicle dependability has slipped to its worst level in over a decade, according to the recently released 2025 J.D. Power U.S. Vehicle Dependability Study (VDS). Owners of three-year-old vehicles—models built in the thick of COVID-19’s supply chain disruptions—are facing more problems than at any time since 2009. With an industry average of 202 problems per 100 vehicles (PP100), the findings highlight a lingering struggle for automakers, especially as vehicles become increasingly tech-heavy.

Software Glitches Take Center Stage

Perhaps unsurprisingly, software-related issues have become the Achilles’ heel of modern vehicles. Android Auto and Apple CarPlay connectivity took the top spot for complaints for the second year running, with problems rising from 6.3 PP100 in 2024 to 8.4 PP100 this year. Bluetooth pairing troubles and in-vehicle Wi-Fi connectivity issues followed closely behind, revealing that as automakers push for more connectivity, the growing reliance on tech is proving to be a double-edged sword.

This wave of tech frustration is exacerbated by the slow adoption of effective over-the-air (OTA) updates. While 36% of respondents said their vehicle received an OTA update within the first three years of ownership, only 30% noticed an improvement, while 56% reported no noticeable change. Automakers may be embracing digital fixes, but the user experience still leaves much to be desired.

Pandemic Disruptions Still Echoing

Jason Norton, director of auto benchmarking at J.D. Power, contextualized the results by pointing to the unique production challenges that plagued the 2022 model year. Supply chain bottlenecks, workforce shortages, and skyrocketing vehicle prices all played a role in the final product quality. These “pandemic cars,” as some have dubbed them, were always expected to struggle in long-term dependability studies—and three years later, the cracks are showing.

Hybrid Vehicles Shine, PHEVs Struggle

While battery electric vehicles (BEVs) made notable strides in reliability—improving by 33 PP100 compared to last year—plug-in hybrid electric vehicles (PHEVs) moved in the opposite direction, seeing a worrying 26 PP100 decline. PHEVs are now the most problematic powertrain type, averaging 242 PP100, while traditional hybrids emerged as the least problematic at 199 PP100, closely followed by gas-powered vehicles at 200 PP100. Diesel vehicles also struggled, averaging 233 PP100.

The narrowing gap between electric and gas-powered vehicles is a promising sign for EV adoption, but PHEVs may need more attention from automakers as the market shifts toward electrification.

New Models vs. Carryover Models

Automakers have long struggled with launching all-new models, and the 2025 study reinforces that pattern. Of the 27 new models introduced for the 2022 model year, only four performed better than their segment average. Fresh designs and first-generation platforms often come with teething issues, as evidenced by new models averaging 241 PP100, compared to the more stable 196 PP100 for carryover models.

Lexus and Buick Lead the Pack

When it comes to brand performance, Lexus secured its position as the most dependable brand overall for the third consecutive year, with a stellar 140 PP100. In the premium segment, Cadillac (169 PP100) and Porsche (186 PP100) followed.

On the mass-market side, Buick topped the charts with 143 PP100, edging out Mazda (161 PP100) and Toyota (162 PP100). Toyota’s reputation for reliability was further reinforced, with the Toyota Avalon crowned the most dependable vehicle overall.

Standout Model-Level Winners

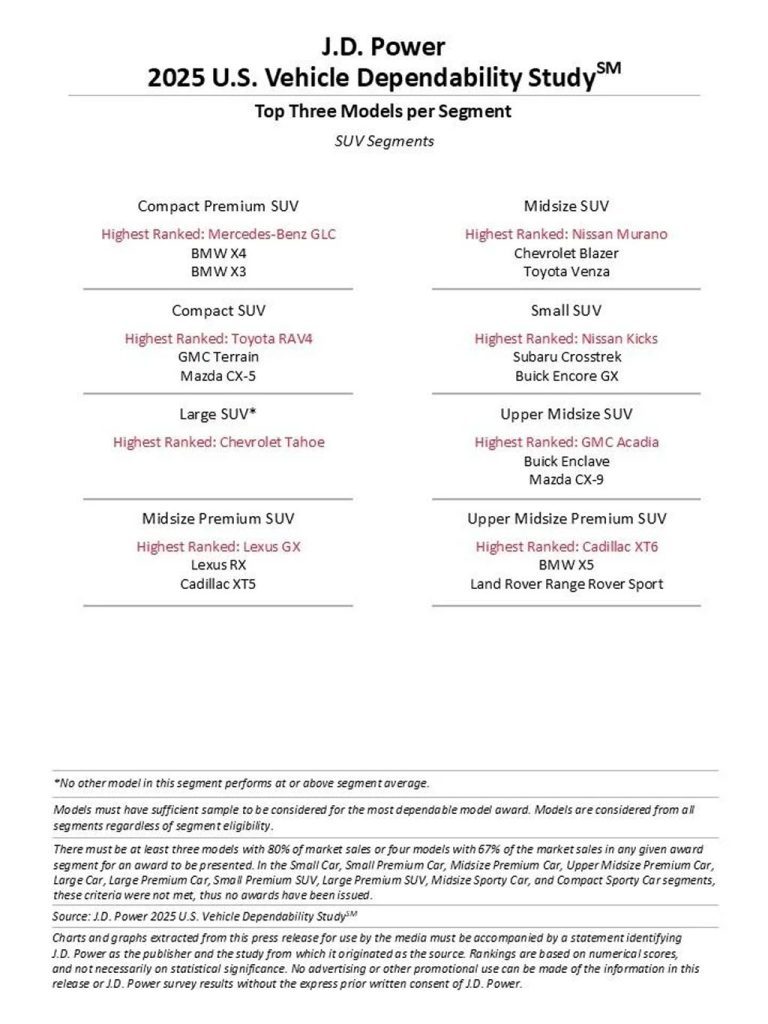

Toyota and General Motors led the way with six model-level awards each:

Toyota Motor Corporation Models:

- Lexus GX

- Toyota Camry

- Toyota Corolla

- Toyota RAV4

- Toyota Sienna

- Toyota Tacoma

General Motors Company Models:

- Cadillac XT6

- Chevrolet Corvette

- Chevrolet Silverado

- Chevrolet Silverado HD

- Chevrolet Tahoe

- GMC Acadia

Nissan also performed well, earning two awards for the Nissan Kicks and Nissan Murano.

What This Means for Consumers

For buyers in the used car market, especially those eyeing 2022 model-year vehicles, the study serves as a cautionary tale. Vehicles built during the height of pandemic-induced turmoil come with a higher risk of tech issues and other quality hiccups. Shoppers may want to prioritize carryover models or stick with brands like Lexus, Toyota, and Buick, which continue to demonstrate consistency in long-term quality.

As automakers navigate the digital transformation of vehicles, dependability may increasingly hinge on software robustness rather than just mechanical reliability. While OTA updates offer hope for easier fixes, the industry clearly has work to do in ensuring these updates translate into real-world improvements.

Three years post-pandemic, the ripple effects are still shaping vehicle dependability. As tech continues to integrate deeper into our driving experience, the challenge for automakers is not just building a reliable vehicle but also ensuring that the software running it is just as dependable.

FOLLOW US TODAY: